27 Aug 2024

.jpg)

A contrasting and polarising June quarter raised more questions than answers, but there were some fleeting glimpses of markets behaving more rationally. Here’s hoping for more of these glimpses.

Following exceptionally strong December and March quarters, particularly for equity markets, the June quarter was one dominated by stalling progress on the inflation-fighting front, the first real obvious signs of weakening economic data, and rising political and geopolitical risks, with a sprinkling of significant election results, a Japanese Yen in free-fall, and the first interest rate cuts in major economies.

It was a poor start to the quarter for markets, with real concerns that the downward trajectory in inflation had stalled, resulting in market expectations for rate cuts being pushed out even further (ie. late 2024 or more likely 2025). This was an interesting, and somewhat crazy contrast, to what kicked off the rally in markets in the fourth quarter of 2023 – ie. predictions of six to seven rate cuts in 2024! Labour markets remained too tight, particularly in Australia and the USA, with services inflation doing most of the damage. Australian house prices continued to rise under the pressure of supply constraints and mass immigration, while US retail sales came in ahead of expectations as consumer spirits rose.

How quickly fortunes (sentiment) can change, particularly in the post-covid period, with the middle of the quarter painting a completely different picture. Real signs of economic weakness suddenly appeared with Australian retail sales going from bad to worse, a pretty significant drop-off in US new jobs data (which has been spurious at best during and in the post-covid period), weaker consumer sentiment & confidence, and Chinese economic data which disappointed and in some cases appeared to be re-weakening again.

This is when we began to see fleeting glimpses that bad economic news is bad for markets. We know that sounds somewhat simple and logical, but markets have largely been operating on the basis that bad news was good for markets; under the guise that their saviour (central bankers with their money printers) would swoop in and save the day. This dynamic has prevailed effectively since the GFC where inflation remained tame and actually under-shot versus central bank targets. However, it doesn’t work so well coming off inflation peaks of 8-9% and where falling inflation had begun to stall. How old we feel reminiscing rational and logical markets!

To top it off, Australian inflation significantly disappointed, with the monthly indicator actually ticking up, confirming concerns that the March quarter print wasn’t an anomaly. There were even calls for both the US and Australian central banks, particularly the latter, to consider further rate hikes, with pressure on keeping a lid on the inflation genie.

Then another fairly swift pivot in sentiment and rhetoric in the weeks that followed, with US inflation meeting expectations (ie. no upside surprises), US jobs data showing further signs of weakening, the first interest rate cuts in developed economies (Canada, Europe, England, Switzerland, Sweden, and NZ), and the US Federal Reserve flagging expectations for one rate cut this year but with dovish undertones (the all-important central bank wordsmithing). And as markets do these days, investors took this as a sign to one-up the US Fed with market expectations implying two US rate cuts for the year, with the first likely in September. Also, an interesting read-through on the Canadian and European central bank rate cuts, with the former trying to stave off recession in the Canadian economy while the latter seemed to be front-running concerns of a European economic drop-off in the period ahead with inflation within target.

Adding to the merry-go-round period described above, investors unusually took proper notice of rising political and geopolitical risks. On the political front, we had UK elections which went as expected (ie. landslide win for Labour), a shock snap election called by French President Macron following a very poor showing for the left-wing parties in the European parliamentary elections, and the Indian Prime Minister Modi winning another term but with a smaller majority, meaning passage of his pro-business policy remit might be harder going forward. The French elections require some explaining in that the “far-right” party won the first round, but then lost the important second round to the “far left” party following deal-making between this party and President Macron’s “centre-left” party to ensure he remained in power. Markets clearly didn’t like the first-round results but seem to revel in the news of a likely hung parliament. We also had new flashpoints on the two-wars front, both US and Europe levying further tariffs on Chinese goods, former President Trump being convicted on charges and awaiting sentencing, plenty of foreign diplomacy with the US visiting China / China visiting Europe / China visiting Australia, and the farcical US presidential debate (as they go of late) which led to Biden withdrawing his presidential candidacy and endorsing Kamala Harris for the Democratic party nomination.

Other considerations in the period included instability in currency markets with the Japanese Yen in freefall, before it spiked and then settled, though the Australian dollar did push higher against the US dollar (impacting unhedged global asset exposures) but not against other currencies. We also had the Australian Federal Budget, with little to no surprises, but the front-ending of their spending program along with well flagged revised tax cuts didn’t help the RBA’s cause.

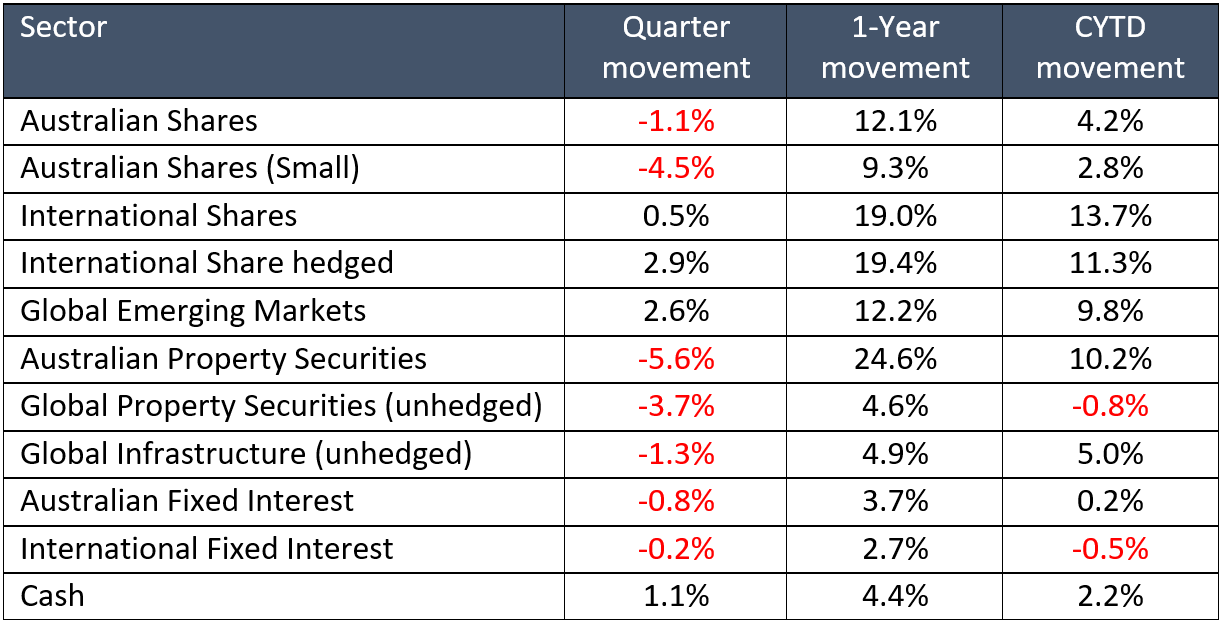

In summary, a very narrow number of winners in the June quarter. Highlights included Chinese equities assisting broader Asian / emerging markets, UK equities within a weak European equity backdrop, US technology trouncing broader US equities, small companies underperforming large companies on weaker economic concerns, and property/infrastructure and bonds hit by rising bond yields (falling prices) as rate cut expectations were pushed out.

Outlook

Our outlook hasn't overly changed but remains somewhat different from consensus (ie. the broader market), which presents both risk and opportunity. We continue to think the market is underestimating the likely characteristics of a “soft landing”, where we expect weaker economic conditions ahead but aren’t necessarily in the recession camp. We also think the equity market is too narrowly focused on a small number of winners, increasingly only benefiting anything A.I. related whilst treating this thematic as somewhat immune from the economic backdrop. History shows that nothing is immune to the economic backdrop, unless we’re now playing with monopoly money.

This goes somewhat to explaining our more cautious tone and stance in portfolios. We still want to participate in markets, but we’re very conscious of the risks surrounding inflated expectations and overcrowded trades. A broadening of market winners would be a welcome reprieve, a boon for truly active managers, given our preference for fundamentally focused/grounded long-term investment approaches.

Asset Class performance – June Quarter 2024

Source: Morningstar Direct

Indices:

As always, if you have any questions or your personal circumstances have changed please do not hesitate to contact your financial adviser.

General Advice Warning - Any advice included in this article has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.